Levblockchain LVE token and holdings Dao v1 contract.

Tokenized DAO

By leveraging blockchain we aim to tokenize assets and holdings to track activities, and reflect the value of the ecosystem and management as a whole into its basic Levblockchain LVE holdings, voting, DAO contract, as well as the managing, voting, token Levblockchain “LVE”.

Developed projects, divisions and acquired companies, tokenized assets, created tokens, will be locked as holdings, in our basic tokenized, voting capable, Dao contract, if needed and beneficial for the ecosystem, however there will always be traditional corporate structure and regulation for the ecosystem.

The total value of all the divisions and their tokens will reflect on the LVE Dao’s and the Levblockchain LVE token’s as a whole, “LVE” holdings structure in real life businesses almost tethered with our Dao’s ecosystem whereas tokenization is possible and if beneficial.

Fractionalized ownership may be beneficial in current and for future development scenarios.

Levblockchain “LVE” Token Information

- Token Name : Levblockchain

- Token Symbol :

“LVE”

“LVE” - Total Token Limited Fixed Supply : 108,000,000

- Token Address : 0xa93f28cca763e766f96d008f815adaab16a8e38b

- Decimals, fractions : 18

- Token Type : Erc-20

- Platform : Ethereum

- Voting Capable Token : Capable

- DAO Address : 0xC48827e8fE197b424847744377771616109A0dE5

- Voting Capable DAO : Capable with “LVE” token

Initial Private Token Offering

Join The Whitelist !

Whitelist your Erc-20/Ethereum Wallet Address to participate, join our initial private token offering.

Click the button below to submit the whitelist google form in few simple steps.

The form contain some additional info.

Initial Private Offering Pair : Tether “USDT” (Erc-20) / Levblockchain “Lve”(Erc-20)

Be whitelisted and notified about our private current offering, date, offering smart contract address, and token-holder updates.

Whitelist – Offering info and updates E-mail: private-offering@lveblockchain.org

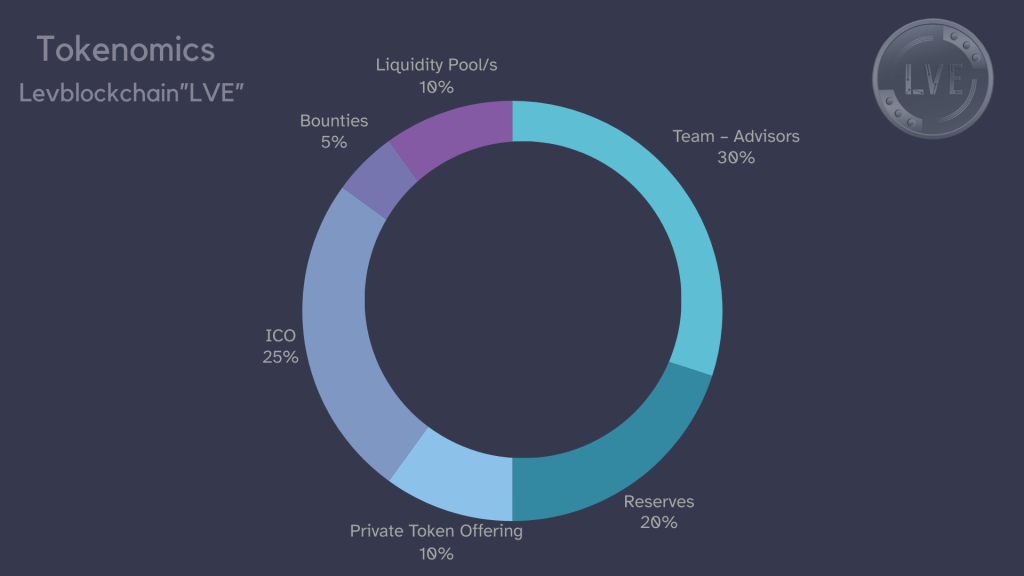

Tokenomics – Allocation, Distribution Projections

- Team – Advisors : 30%

The team allocation 20% is designated for the core team members who drive the project’s development, innovation, and execution. It incentivizes team members to work diligently towards achieving the project’s goals while aligning their interests with the long-term success of the project. Additional allocation is reserved approximately around ~ 10%for advisors and contributors who provide strategic guidance, expertise, and support to the project. It ensures that these key stakeholders are incentivized and aligned with the project’s success.

- Reserves : ~20%

Tokens allocated to reserves are held for future development, strategic partnerships, ecosystem growth, and other operational needs of the project. This allocation provides flexibility and resources to support the project’s long-term sustainability and evolution.

- Initial Private Token Offering : 10%

Reserved for early investors and strategic partners, the private sale allocation provides an opportunity for selected participants to acquire tokens before public availability. It helps secure initial funding and establish partnerships crucial for the project’s growth.

- Fundraising Targets :

Fundraising – Offering Rounds Consist of : PTO, ICO or IEO, and Open Exchange Listing.

Soft Cap : 200,000$

Hard Cap : 4,000,000$

*Targets according to current phase and near term valuation projections.

- Bounties, Airdrops (Past & Future) : 5~6%

A portion of tokens is allocated for airdrops and bounty programs, which are initiatives aimed at fostering community engagement, rewarding early supporters, and incentivizing specific actions within the ecosystem. It encourages participation and contributes to the project’s community building efforts.

- Public Sale : 25%

The public sale allocation is dedicated to offering tokens to a broader audience during the project’s public sale phase. It allows for widespread distribution, democratizing access to the project’s tokens and fostering a diverse and engaged community of token holders.

- Liquidity Pool/s : 10~15%

This allocation is dedicated to creating and maintaining liquidity pools for the project’s tokens, ensuring ample liquidity on decentralized exchanges (DEXs) and facilitating smooth trading experiences for users. It enhances the token’s market accessibility and stability.

- Circulating Supply : 50~55%

The approximate circulation denotes the portion of tokens expected to be actively traded and utilized within the ecosystem at the project’s inception. It reflects the liquidity and accessibility of the tokens in the market, influencing their value dynamics and ecosystem participation.

* Projections, tokens to be held by community and public after main round and/or exchange offering.

*Tokenomics projections as per the main round, ico, ieo and/or direct listing.

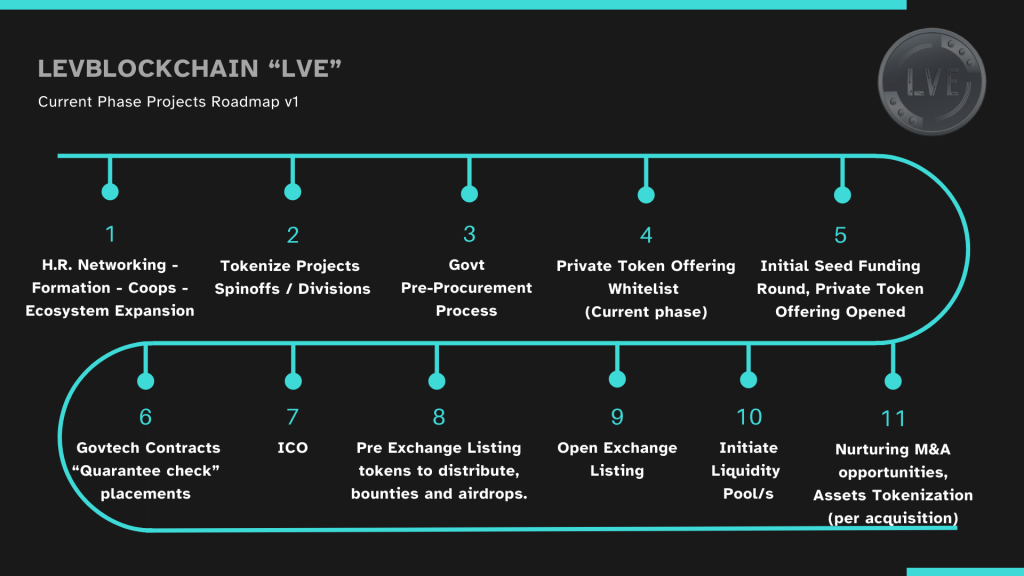

Levblockchain “LVE” Roadmap

- H.R. Networking – Formation – Coops – Ecosystem Expansion

This phase involves strategically building relationships within the industry, forming cooperative partnerships, and expanding the ecosystem by connecting with key players and stakeholders. It’s about fostering a robust network of human resources, which is vital for collaboration and growth in a competitive landscape.

- Tokenize Projects – Spinoffs / Divisions

This step entails converting various projects, spinoffs, or divisions into tokenized assets. Tokenization involves representing ownership or rights to an asset digitally on a blockchain. By tokenizing projects, spinoffs, or divisions, the organization can potentially increase liquidity, enable fractional ownership, and broaden investment opportunities.

- Govt Pre-Procurement Process

Engaging in the government’s pre-procurement process involves preparing for potential contracts or tenders with governmental bodies. This could include understanding the requirements, ensuring compliance with regulations, and positioning the organization to effectively compete for government contracts, which can be substantial sources of revenue and validation.

- Private Token Offering Whitelist (Current phase)

At this stage, the organization is curating a whitelist of participants for a private token offering. By limiting participation to a select group the organization aims to ensure regulatory compliance and target investors who can provide meaningful support.

- Initial Seed Funding Round, Private Token Offering Opened

Launching a private token offering for initial seed funding marks the beginning of fundraising efforts. This round targets early-stage investors and supporters who believe in the project’s vision and potential. It provides crucial capital to kickstart operations, develop products or services, and achieve milestones necessary for future growth and investment rounds.

- Govtech Contracts “Guarantee check” placements

Securing government technology contracts involves undergoing assurance checks or guarantee placements. This process may include demonstrating technological capabilities, compliance with security standards, and the ability to meet the government’s specific needs. Winning government contracts can provide steady revenue streams and enhance credibility in the market.

- ICO (Initial Coin Offering) ~ IEO (Initial Exchange Offering)

An Initial Coin Offering (ICO) is a fundraising method where a project sells digital tokens to early investors by a smart contract or by initial exchange offering (IEO). This process typically involves a cryptocurrency token or utility token to fund project development. ICOs & IEOs offer investors the opportunity to support projects.

- Pre-Exchange Listing, tokens to distribute, bounties, and airdrops

Prior to listing tokens on public exchanges, the organization distributes tokens through various means such as bounties and airdrops. Bounties reward individuals for completing specific tasks or activities that contribute to the project’s growth, while airdrops distribute tokens to holders of a specific cryptocurrency or to participants in a project’s community.

- Open Exchange Listing/s

Listing tokens on open exchanges enables broader trading and liquidity for investors. It provides accessibility to a wider range of buyers and sellers, which can increase trading volumes and price discovery. Being listed on reputable exchanges also enhances the project’s visibility and credibility and volume within the cryptocurrency market.

- Initiate Liquidity Pool/s

Launching liquidity pools involves providing a platform for users to trade tokens with liquidity provided by the participants and/or the project. Liquidity pools facilitate efficient trading by ensuring there are enough tokens available for buyers and sellers to transact without significant price slippage. They play a crucial role in decentralized finance (DeFi) ecosystems and token trading platforms.

- Nurturing M&A opportunities, Assets Tokenization (per acquisition)

Actively pursuing acquisitions (M&A) opportunities involves identifying potential targets and negotiating deals to acquire complementary businesses or assets. Tokenization of acquired assets can unlock additional value by digitizing ownership and enabling fractional investment. M&A activities can strengthen the organization’s market position, diversify revenue streams, and drive growth.

Exchange Listing of Token

The inclusion of our token on exchanges is a matter of considerable significance, bearing weight not only for our organization but also for our stakeholders.

Thus, it is imperative that we approach this prospect with meticulous attention, striving for equilibrium and enduring advantages for all stakeholders and the fostering of our growth trajectory.

With an evident surge in demand, we are presently in deliberation and negotiation with numerous esteemed exchanges.

Our primary objective is to secure an arrangement that is both optimal and exclusive, emphasizing enduring cooperation and listing privileges for sustained mutual growth.